Top 10 Considerations For the Quintessential AP/AR Solution

Whether you are evaluating a new platform in Account Payable and Account Receivable automation, or simply performing a periodic health check to ensure you are staying competitive, you should consider these 10 factors for the quintessential AP/AR automation solution:

- Is it locking you into a particular accounting, finance, or ERP package? Large monolithic platform can hold you hostage and limit your freedom to choose.

- Does it integrate with what you have? Don’t accept rip-and-replace as the only option, it drives up the cost and risk, and you are bearing all of it. The choice should be yours, not theirs. Once you complete the conversion, it is very difficult, and often impossible, to revert to the previous state. If your backend stays intact, you can simply turn it off if it does not meet your need.

- What is the highest level of automation it provides? – this directly impact your savings and error rate. Even with complex approval logic and business rules, 100% is now possible with the latest technology.

- Is it an AP/AR pure play, or is it a small add-on to a large package? Where they make money affects the pace of innovation and how much they care.

- Is inbound/outbound payment processing part of the package? This last mile is often the most expensive and fragile part of your operation, it should provide an integrated option. Again, there should be a choice, and it should be yours to make.

- Are they providing both AP and AR automation? You will need both at some point. Comprehensive cash management requires you to ultimately coordinate and orchestrate both the inflow and outflow operations in order to meet a cashflow, working capital, or cash conversion cycle objective.

- Can your business users change the automation flow without IT involvement? Your operation will evolve over time, you cannot afford to wait for others outside of your control to make every little change. When there is a wait, you are required to manually augment the processing until the change is implemented. This is the element that are often overlooked when deciding on a solution, and it has the longest lasting impact.

- How much do you have to maintain? Unless you have a business or legal requirement to keep the system and data in-house, you should run it in the cloud if it is certified and secure. You will always be on the latest and greatest, and it can grow with your business without worrying about capacity. It eliminates much of the initial sunk cost and on-going maintenance cost.

- How much and how long does it take to implement? Time and money matter.

- Is there a large up-front platform commitment? Avoid sunk cost – unless they are willing to guarantee the result. Be smart, there is a reason they call it “sunk” cost.

In Juno Payments, we apply this set of criteria towards everything we do. Whether you have an existing AP/AR automation solution, or still processing some activities manually, we hope these considerations will help you make better decisions. Knowledge is power.

In Juno Payments, we apply this set of criteria towards everything we do. Whether you have an existing AP/AR automation solution, or still processing some activities manually, we hope these considerations will help you make better decisions. Knowledge is power.

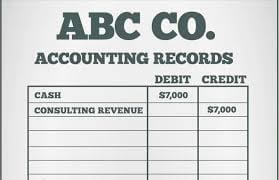

The method of manually recording transaction details soon became obsolete with the rise of modern mechanics and industrialism. Increasing complexity of transactions as well as the sheer number of them rendered this process useless. This gave birth to the first “mechanical” solution to invoicing and record keeping, “loose leaf accounting.” This technique allowed for records to be added and removed at will from an organizational “binder” type device. As innovative as this new system was, many believe it gave birth to the first instances of fraud.

The method of manually recording transaction details soon became obsolete with the rise of modern mechanics and industrialism. Increasing complexity of transactions as well as the sheer number of them rendered this process useless. This gave birth to the first “mechanical” solution to invoicing and record keeping, “loose leaf accounting.” This technique allowed for records to be added and removed at will from an organizational “binder” type device. As innovative as this new system was, many believe it gave birth to the first instances of fraud. 1982 witnessed the birth of the internet and with it, opportunities to advance invoicing technologies. The ultimate goal of advancement of these programs is to do more in less time. There have been an abundance of workflow tools developed, many of which are still used today. While workflow tools are useful, they still allow for errors that true automation systems eliminate.

1982 witnessed the birth of the internet and with it, opportunities to advance invoicing technologies. The ultimate goal of advancement of these programs is to do more in less time. There have been an abundance of workflow tools developed, many of which are still used today. While workflow tools are useful, they still allow for errors that true automation systems eliminate.