Understanding Different Invoice Types

There is no “standard” format for an invoice, they differ in relation to industries, processes and many other variables. For example, an invoice related to transportation is not formatted the same way or used in the same sense as a retail invoice. Invoices used for services rendered on time, hourly or daily basis, are very different from those made out products bought or sold. In general, they can be of several common types:

Standard Invoice:

Standard Invoice:

This is the most common type of invoice that you come across regularly. They exist in electronics form such as templates that you can use with a word processing package, or paper forms you can purchase from office supply store. Typical information such as name, address, customer number, invoice number, item description, quantity, per unit cost, shipping, tax, total cost, due date, payment terms, and payment options etc… They are used across a broad range of industry of all sizes.

Proforma Invoice:

It is an abridged or estimated invoice sent by a seller to a buyer in advance of a shipment or delivery of goods. It notes the kind and quantity of goods, their value, and information such as weight and transportation charges. Pro forma invoices are commonly used as preliminary invoices with a quotation, or for customs purposes in importation. They differ from a normal invoice in not being a demand or request for payment.

Commercial Invoice:

Commercial invoice is the primary document used for importation control, valuation, and duty determination. It identifies the products being shipped, and is a customs document when used in foreign trade, or when exporting an item across international borders.

The form could include items such as name, address and phone for shipper and consignee, Terms of Sale (Incoterm), item description, Harmonized Tariff Codes, number of units, unit value, and total value of each item, etc…

Credit Note (Memo):

A credit memo informs a buyer that the seller will be decreasing or crediting the amount that the buyer owes in accounts payable, thus decreasing the amount of accounts receivable in the seller’s account. It is often issued when a seller has made some sort of mistake, or something requires an adjustment towards a sale.

Credit memos from a bank are usually in regard to reversing transactions in which it made a payment it should not have, or a collection it made upon a note receivable or a certificate of deposit. When the latter occurs, the bank will transfer the collection of funds into the depositor’s account.

Debit Memo:

A debit memo informs a buyer that the seller is debiting or increasing its amount in the accounts receivable, thus increasing the amount of the buyer’s accounts payable due to extenuating circumstances.

It is often issued when a seller has not billed or charged enough to the buyer, or it might come from another error or any other factor requiring an adjustment. When a seller issues a debit memo, it is normally required that the seller give specific details why it is being issued.

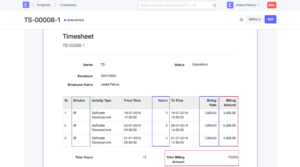

Timesheet Invoice:

Timesheet Invoice:

Timesheet invoice is a blend of an invoice and timesheet, in which it records day and time spent on a particular project. It includes the name and the description of the project, as well as the amount the client owes based on time spent. It is often used in professional services and consulting.

Self-billing invoice:

Self-billing is a commercial arrangement in which the buyer agrees to prepare the invoice on-behalf of the seller and issue the invoice to himself. The invoice, along with the payment, is then sent to the seller for processing.

The benefit to the seller is shorter Days Sales Outstanding and shifting the cost of invoice creation to the buyer. The buyer benefits from having tight control of what was billed, and minimizes disputes due to incorrect billing. However, this model shortens the Days Payable Outstanding and can have negative impact on the buyer’s working capital. So the use is not wide spread and is limited to special cases such an employee insurance policy billing between an employer and a carrier.

Recurring Invoice:

Recurring invoicing requires permission from the buyer to be charged on a regular basis for a set amount. The repetition will continue until an agreed-upon termination date or when the buyer withdraws permission. The prime examples include online subscription, cable companies, utilities, and gym membership.

The benefit is obviously the reduction in billing cost due to the automation. But if there is an error in the process, it is not always found initially as the receiver often becomes used to the repetitive nature of the invoice. Reversing and correcting the error would require multiple steps and compensating transactions, thereby making it much more costly.

Due to the constantly changing business climate and supplier/customer mix, a well-run AP/AR department should always be prepared for new invoice types. When it occurs, processing delay should be within the established guideline, and the processing exception should be a one-time, rather than a recurring event. Key capabilities such as OCR and fields mapping of the new invoice to the appropriate entry in your finance/accounting system should be easily accomplishable by your department staff, without having to resort to outside consultants or internal IT staff. This agility and flexibility in invoice processing would reward your firm with a stable and healthy cash management.

In Juno Payments, we apply this set of criteria towards everything we do. Whether you have an existing AP/AR automation solution, or still processing some activities manually, we hope these considerations will help you make better decisions. Knowledge is power.

In Juno Payments, we apply this set of criteria towards everything we do. Whether you have an existing AP/AR automation solution, or still processing some activities manually, we hope these considerations will help you make better decisions. Knowledge is power.