Overview:

The client is a wholly-owned government corporation with a fundamental mission to employ and provide job-skills training to inmates. It accomplishes this goal by producing market-priced quality goods and services that are exclusively sold to Federal Government agencies. The client has over 100 factories in federal prisons, producing approximately 175 different types of products and services including textiles, electronics, vehicular components, industrial products, ycling activities, data entry and encoding. The client uses SAP Enterprise Central Component to support the sales and finance cycles and has implemented the Sales and Distrubution (SD) and Financial Accounting (FI) modules.

Client Situation:

The primary customers for the client are servicemen and women who are deployed around the world. These soldiers make purchases with credit cards and GSA SmartPay Cards that have limited credit. Under the previous system, failed purchase attempts and numerous authorizations erroneously reserved available credit that would otherwise be needed by the buyer. Additionally, as more transactions failed and the credit limit was exceeded, it was difficult for the client to ship goods until the account was reviewed and corrected. Many orders had multiple authorizations for a single invoice and the customer, as a result, would see multiple charges on their statements.

The client charted a project to address these issues and set the following goals:

- Increase order accuracy and decrease repetitive authorizations

- Provision and deliver orders more quickly and reduce the fulfillment delays so that our soldiers receive purchases sooner (of critical importance given the nature of their work).

- Provide better and error-free assistanc to our servicemen and women

The client identifed the following cricial factors for a successful implementation:

- Secure all transactions

- Implement a method to “void” a credit card transaction

- Include additional order information (sales orer and invoice numbers) on the billing statement

- Ensure one authorization per invoice

- Design a method to prevent returns from being credited to expired cards

- Create a mechanism to infom customers that their card will not be billed until their item is shipped unless they request advance billing

Solutions:

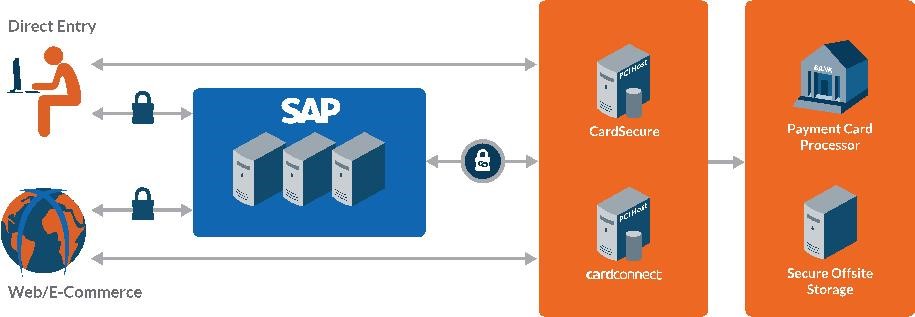

To address the challenges, the client integrated payments into SAP. The goals were met by providing client with the following solutions:

On- Demand Authorizations and Settlement – Executes authorizations and settlements on-demand and made visible on orders and invoices. This is done at both the order level and invoice level.

Authorization and Settlement Reports – Shows a daily transaction log from your various payment sources ( ie. e-commerce, SAP, CardClear, etc.)

CardClear – Provides greater flexibility in charging payments in a timely manner. CardClear allows payments to be charged only afer the items were shipped and prevents charges from exceeding the credit limit.

Settlement Consolidation – Eliminates multiple charges appearing on the statement by allowing a single authorization on the invoice.

CardSecure – Tokenizes customer credit card information during transactions and severely limits the chance of fraud.

Authorization Reversal – Allows the merchant to void previous authorization attempts.

These solutions and more are included in Juno Payments powered by Card Connect’s comprehensive suite of offerings for SAP users.

The client was able to:

- Reduce sales cycle time by integrating payments

- Decrease PCI scope by using tokenization

- Lower fees per transaction

- Improve sales and finance processes by eliminating non-value added steps

- Add features and functionality that enhanced the customer experience

- Keep SAP ECC compliant for future releases

If this sounds like a solution for your business contact us!

1-888-514-8118

Read More