How the Dunning Process Works and How to Avoid It

Dunning is derived from a 17th century verb (dun) which means demanding payment of a debt, it represents the steps taken to collect overdue balance. As accounts become more overdue, this process can become increasingly invasive.

The first step is normally a letter that outlines the late payment per the previously agreed upon payment due date. Some institutions have systems in place that automate certain aspects of the dunning process, they include tracing customers who have pending payments, to notifying and involving collection agencies.

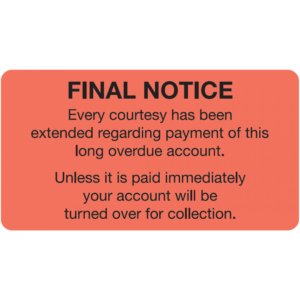

The severity of collective actions is determined by several contributing factors such as how long overdue the payment is, the amount of the payment, and the relationship between the two parties. Once collection agencies are involved, they will go through internal processes of collection which include everything from simple notices to serious legal actions.

How can this nightmare of a scenario be avoided? Most would think it is fairly simple, pay your invoices on time. But as we all know, depending on your internal AP/AR processes, this is not always as simple as it sounds.

One way is to maintain a trustworthy team managing your internal processes, who would ensure those process continue to evolve and become more efficient. Granted, there will always be anomalies, but hopefully not enough to find yourself fighting your way out of a dunning process.

Keeping healthy business relationships is another way to minimize your dunning risk. Collection agencies only become involved in the dunning process if the payee requests them to be. This can often be avoided by keeping positive and respectful working relationships, and by letting them know they are valued. A business relationship is often more important than a single invoice.

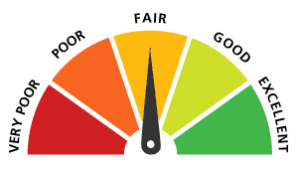

Dunning process damages your credit rating and lowers your ability to obtain favorable payment terms. If the root cause for missed payment is due to errors and bottlenecks in your AP organization, there is no reason these cannot be eliminated, it makes good business sense.

The easiest way to avoid late payments and dunning processes is true automation. Juno Payments offers a solution to fully automate your procure-to-pay and order-to-cash processes. It removes late/missed payments due to human errors and bottlenecks, your focus can shift from chasing payments to never missing early payment discounts.

The easiest way to avoid late payments and dunning processes is true automation. Juno Payments offers a solution to fully automate your procure-to-pay and order-to-cash processes. It removes late/missed payments due to human errors and bottlenecks, your focus can shift from chasing payments to never missing early payment discounts.

We would appreciate an opportunity to work with you and share how this can be accomplished.

Executive Summary

Executive Summary Drivers for change

Drivers for change We hope this set of drivers resonate with you and help you to identify those latent requirements that have yet to be defined. We would love to learn from you those needs that are unique to your firm, or those that we have missed.

We hope this set of drivers resonate with you and help you to identify those latent requirements that have yet to be defined. We would love to learn from you those needs that are unique to your firm, or those that we have missed.