Empowering your finance staff to be self-sufficient

When one compares two enterprises with seemingly equivalent business technology platforms, and finding one being far more agile to accommodate changes than the other, the “secret sauce” is often hidden in detail not reflected in business capabilities. One of the most common differentiator is how self-sufficient the business users are in implementing changes, it is especially important for those operating in a dynamic business environment.

In raising our children, we emphasize in enabling them to become self-sufficient, we don’t want them asking us to tie their shoelace every morning when they are 30. But as an adult, we often accept paradigm for relying on others. It is not about refusing help when we need it, it is about questioning whether certain tasks should be so hard that prevent us to do them ourselves, especially if we can do it faster and better than others.

In raising our children, we emphasize in enabling them to become self-sufficient, we don’t want them asking us to tie their shoelace every morning when they are 30. But as an adult, we often accept paradigm for relying on others. It is not about refusing help when we need it, it is about questioning whether certain tasks should be so hard that prevent us to do them ourselves, especially if we can do it faster and better than others.

In the legacy technology of the past, applications took years to design and build, and stayed relatively stagnant for years, or even decades. Corporate IT was king, they were in control and had substantial power over business applications. But that was also an era where there was little global competition, and corporations could bury inefficiencies, inflexibility, and arrogance with market dominance.

Nowadays, competition is borderless and fierce. To stay on top of the game, enterprises must be agile and respond to changes and new challenges rapidly. The power shifted from corporate IT to the line-of-business (LOB) in the last decade, the LOB now owns the initiative and the funding – as it should be, as they are ultimately responsible for the outcome. But the paradigm of relying on IT to implement changes and maintain systems remains in many cases.

Such approach creates inefficiency by introducing a group that has less intimate knowledge of the business processes, it is particularly severe if it is an outsourced to transient consultants and contractors who has no knowledge of your business. Fresh faces show up when you need follow-up or changes – which is the norm in most cases as projects are staffed by whomever happens to be on the bench. Tremendous staff time in the LOB is wasted in teaching someone about business processes, and in articulating the changes desired.

Unfortunately, these impacts are only reflected in frustration and lack of agility, and rarely captured in KPIs and metrics that drive actions and changes.

Take invoice processing for example, invoice types and processing flows are not static. If you have a large supplier base, it is routine to encounter new invoice types or need to create/change approval flow weekly or daily. If you require others to implement changes, you are processing these invoice exceptions manually while you wait.

One of the most important technology innovation is not increase in speed, but in making it easy to use by improving human-technology interface. With proper design, kids can effortlessly navigate their tablets when they are 2 years old. So don’t take “This system is really not meant for you to make changes yourself” as an answer, that was only true back in the 90’s, it is to your best interest to demand better.

One of the most important technology innovation is not increase in speed, but in making it easy to use by improving human-technology interface. With proper design, kids can effortlessly navigate their tablets when they are 2 years old. So don’t take “This system is really not meant for you to make changes yourself” as an answer, that was only true back in the 90’s, it is to your best interest to demand better.

Business user self-sufficiency should be one of your top requirements in business applications. Business process and rules customizer should be drag-and-drop, without programming or development required. With new invoice types, it should score very high ingestion accuracy out-of-the-box, any fine tuning should be machine-learning aided, so you teach once and forget. The goal is to enable the finance department to make changes in minutes, rather than waiting days or weeks for IT assistance while you manually process these new invoice types. By minimizing cross-department coordination, you can become more agile, cut cost, and eliminate a lot of headaches.

While questions like “Do you integrate with my accounting package?”, “How long does it take?”, “How much does it cost?” are intuitive, the equally important questions such as “What is your integration approach?”, “What is the delay between data synchronization?”, “Is the integration two-way or one-way?”, “How do you handle conflicts?” are often not asked.

While questions like “Do you integrate with my accounting package?”, “How long does it take?”, “How much does it cost?” are intuitive, the equally important questions such as “What is your integration approach?”, “What is the delay between data synchronization?”, “Is the integration two-way or one-way?”, “How do you handle conflicts?” are often not asked.

Standard Invoice:

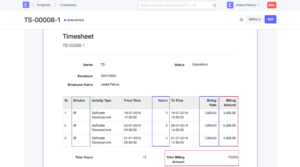

Standard Invoice: Timesheet Invoice:

Timesheet Invoice: