Leveraging Machine Learning in Finance Operations

Machine learning is a technology that has quickly becoming a topic of interest across a variety of organizations. What is machine learning? What’s so special about it? What is its implication towards finance? What are some use cases? These are the topics we will discuss.

Machine learning is a technology that has quickly becoming a topic of interest across a variety of organizations. What is machine learning? What’s so special about it? What is its implication towards finance? What are some use cases? These are the topics we will discuss.

In the past, decision branching and the processing of data in software were both static instructions “programmed” into the computer. It was fine for something that never changes, but as we know, there’s no constant in business today. Everything is either evolving or drastically changing, one can no longer outline and predefine the responses to every possible scenario.

In this old model, every time there’s a change, the computer will need to be “reprogrammed” by a skilled developer. Having been the liaison between business and technology for 30 years, I can tell you one constant: No matter how small a change you consider, the project will never start on the date you want, and it will always take longer to implement than your anticipation. It is no fault of the IT department, they are constantly overwhelmed and fighting fires. They rarely share the same priority or timeline with the business organizations due to their workload and constraints, thus the love-hate relationship between the two. You can fix it by greatly expanding the IT staff, a proposition that is simply impossible given today’s cost pressure.

In this old model, every time there’s a change, the computer will need to be “reprogrammed” by a skilled developer. Having been the liaison between business and technology for 30 years, I can tell you one constant: No matter how small a change you consider, the project will never start on the date you want, and it will always take longer to implement than your anticipation. It is no fault of the IT department, they are constantly overwhelmed and fighting fires. They rarely share the same priority or timeline with the business organizations due to their workload and constraints, thus the love-hate relationship between the two. You can fix it by greatly expanding the IT staff, a proposition that is simply impossible given today’s cost pressure.

Along came machine learning, it is a branch of artificial intelligence based on the idea that machines should be able to learn and adapt through experience. If a machine can learn on its own, as our business evolves, theoretically it can observe these changes and modify its behavior without developers. Although the concept dated to 1959, it was only within the last few years when we began to see its emergence in business applications. In areas such as invoice processing automation, it is starting to modernize the way these tedious day-to-day actions are performed and organized.

Invoice processing often involves complex, poorly-defined and circuitous process flow amongst multiple parties, new exceptions and formats are encountered regularly. Wouldn’t it be nice if a business user can teach it to properly read, route, classify and process the invoice once, and the computer will learn this new pattern and automatically reapply it if this scenario happens again? That is what machine learning is! Without involving IT developers, the platform would learn and automatically apply the new rules for similar “out of the box” step, and the OCR engine will always read the new invoice format properly in the future. There is no more change documentation and backlog, you no longer have to repeat the manual override steps until the system is reprogrammed. It is ready to learn 24×7, including all holidays and Super Bowl weekend. With machine learning, the learning is instant, the changes immediate. Think of the time saved throughout the approval process as well as the benefits by having a system that is constantly learning and evolving to your business needs.

Without having to exhaustively capture all possible scenarios, you can spend less time in front of a whiteboard with process consultants, and your initiatives can enter production and deliver value many months ahead of the traditional approach. You just eliminated analysis-paralysis, which tends to be root cause for runaway projects.

Without having to exhaustively capture all possible scenarios, you can spend less time in front of a whiteboard with process consultants, and your initiatives can enter production and deliver value many months ahead of the traditional approach. You just eliminated analysis-paralysis, which tends to be root cause for runaway projects.

In Juno Payments, we are delivering a machine learning-enabled invoice automation solution. It allows you to see savings in as little as 30 days, and allow the finance department to be self-sufficient in implementing most future changes.

We hope this article resonates with you. We would appreciate an opportunity to sharing more on how your business can benefit from machine learning, and design a solution that is right for you.

Want to Learn More?

1-888-514-8118

[email protected]

www.junopayments.com

Read More

Take invoice processing for example, majority of the most efficient, lowest cost organizations are dominated by the Fortune 500 companies. Their invoice volume is much higher, so the efficiency gain and savings can justify the high expense of the automation platform.

Take invoice processing for example, majority of the most efficient, lowest cost organizations are dominated by the Fortune 500 companies. Their invoice volume is much higher, so the efficiency gain and savings can justify the high expense of the automation platform.  One last thing you should consider is future-proofing your finance organization? Invoice processing is no longer the static business of the past, there are various emerging technology that could transform the business model in the future. For SMB, they can’t afford to dedicate resources to study enablers such as shared ledger like BlockChain, cryptocurrencies like Bitcoin, innovations like artificial-intelligence, etc… With the TaaS model, the burden of innovation is shifted from the business to the TaaS provider, new capabilities can now be added on-the-fly, and the business can stay at the forefront of technology.

One last thing you should consider is future-proofing your finance organization? Invoice processing is no longer the static business of the past, there are various emerging technology that could transform the business model in the future. For SMB, they can’t afford to dedicate resources to study enablers such as shared ledger like BlockChain, cryptocurrencies like Bitcoin, innovations like artificial-intelligence, etc… With the TaaS model, the burden of innovation is shifted from the business to the TaaS provider, new capabilities can now be added on-the-fly, and the business can stay at the forefront of technology.

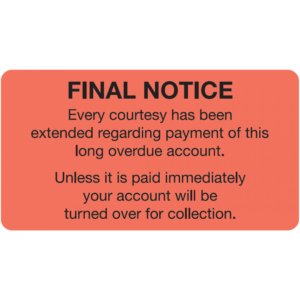

The easiest way to avoid late payments and dunning processes is true automation. Juno Payments offers a solution to fully automate your procure-to-pay and order-to-cash processes. It removes late/missed payments due to human errors and bottlenecks, your focus can shift from chasing payments to never missing early payment discounts.

The easiest way to avoid late payments and dunning processes is true automation. Juno Payments offers a solution to fully automate your procure-to-pay and order-to-cash processes. It removes late/missed payments due to human errors and bottlenecks, your focus can shift from chasing payments to never missing early payment discounts.