THE FASCINATING HISTORY OF AP/AR

While accounts payable and accounts receivable processes seem to be progressing into a new age, the origin of invoicing dates back all the way to the stone age. It is always interesting to learn where and how this process began and how much it differs from processes today.

It is not surprising that the earliest records of transactions and their details comes from the first clay tablets of the ancient Sumerians. The earliest records of sale on these tablets were discovered with references to the most important daily needs, beer and bread. The physical act of transcribing and recording sales records remained relatively unchanged until the time of the Romans. Tedious calculations became easier with the arrival of the abacus, often referred to as the first calculator. It allowed for simple calculations using beads and provided a visual confirmation of calculations and pricing for both parties involved.

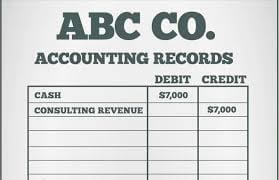

The middle ages brought us the next generation of financial and transactional record keeping – the invoice book. The use of books for record keeping by merchants gave birth to the double entry bookkeeping system. What does this mean? This was the first time that a transaction was recorded twice, once as a debit and once as a credit. Transactional details started emerging around this time as well such as pricing, dates, names of customers, and product descriptions. Once the specifics and details of transactions started becoming the standard, the path was set for modern invoicing and accounting basics.

The method of manually recording transaction details soon became obsolete with the rise of modern mechanics and industrialism. Increasing complexity of transactions as well as the sheer number of them rendered this process useless. This gave birth to the first “mechanical” solution to invoicing and record keeping, “loose leaf accounting.” This technique allowed for records to be added and removed at will from an organizational “binder” type device. As innovative as this new system was, many believe it gave birth to the first instances of fraud.

The method of manually recording transaction details soon became obsolete with the rise of modern mechanics and industrialism. Increasing complexity of transactions as well as the sheer number of them rendered this process useless. This gave birth to the first “mechanical” solution to invoicing and record keeping, “loose leaf accounting.” This technique allowed for records to be added and removed at will from an organizational “binder” type device. As innovative as this new system was, many believe it gave birth to the first instances of fraud.

As some say the birth of modern invoicing and accounting came from loose leaf processes, others say modern techniques share a birthday with the first computer developed in 1941. However, early computing software involved a lot of manual processes that left room for errors and miscalculations. The evolution of floppy and compact disks allowed for more advanced programs to be installed directly onto computers.

1982 witnessed the birth of the internet and with it, opportunities to advance invoicing technologies. The ultimate goal of advancement of these programs is to do more in less time. There have been an abundance of workflow tools developed, many of which are still used today. While workflow tools are useful, they still allow for errors that true automation systems eliminate.

1982 witnessed the birth of the internet and with it, opportunities to advance invoicing technologies. The ultimate goal of advancement of these programs is to do more in less time. There have been an abundance of workflow tools developed, many of which are still used today. While workflow tools are useful, they still allow for errors that true automation systems eliminate.

Juno Payments, we offer a fully automated invoice-to-pay and order-to-cash platform that utilizes machine learning to increase productivity and efficiencies, reduce fraud and errors, and pave the way for the newest generation of AP/AR platforms. If you would like to learn more about what sets us apart and how we can help you evolve your invoicing processes, please let us know and we look forward to working with you to help you out of the old and into the new!

Machine learning is a technology that has quickly becoming a topic of interest across a variety of organizations. What is machine learning? What’s so special about it? What is its implication towards finance? What are some use cases? These are the topics we will discuss.

Machine learning is a technology that has quickly becoming a topic of interest across a variety of organizations. What is machine learning? What’s so special about it? What is its implication towards finance? What are some use cases? These are the topics we will discuss.  In this old model, every time there’s a change, the computer will need to be “reprogrammed” by a skilled developer. Having been the liaison between business and technology for 30 years, I can tell you one constant: No matter how small a change you consider, the project will never start on the date you want, and it will always take longer to implement than your anticipation. It is no fault of the IT department, they are constantly overwhelmed and fighting fires. They rarely share the same priority or timeline with the business organizations due to their workload and constraints, thus the love-hate relationship between the two. You can fix it by greatly expanding the IT staff, a proposition that is simply impossible given today’s cost pressure.

In this old model, every time there’s a change, the computer will need to be “reprogrammed” by a skilled developer. Having been the liaison between business and technology for 30 years, I can tell you one constant: No matter how small a change you consider, the project will never start on the date you want, and it will always take longer to implement than your anticipation. It is no fault of the IT department, they are constantly overwhelmed and fighting fires. They rarely share the same priority or timeline with the business organizations due to their workload and constraints, thus the love-hate relationship between the two. You can fix it by greatly expanding the IT staff, a proposition that is simply impossible given today’s cost pressure. Without having to exhaustively capture all possible scenarios, you can spend less time in front of a whiteboard with process consultants, and your initiatives can enter production and deliver value many months ahead of the traditional approach. You just eliminated analysis-paralysis, which tends to be root cause for runaway projects.

Without having to exhaustively capture all possible scenarios, you can spend less time in front of a whiteboard with process consultants, and your initiatives can enter production and deliver value many months ahead of the traditional approach. You just eliminated analysis-paralysis, which tends to be root cause for runaway projects.  Take invoice processing for example, majority of the most efficient, lowest cost organizations are dominated by the Fortune 500 companies. Their invoice volume is much higher, so the efficiency gain and savings can justify the high expense of the automation platform.

Take invoice processing for example, majority of the most efficient, lowest cost organizations are dominated by the Fortune 500 companies. Their invoice volume is much higher, so the efficiency gain and savings can justify the high expense of the automation platform.  One last thing you should consider is future-proofing your finance organization? Invoice processing is no longer the static business of the past, there are various emerging technology that could transform the business model in the future. For SMB, they can’t afford to dedicate resources to study enablers such as shared ledger like BlockChain, cryptocurrencies like Bitcoin, innovations like artificial-intelligence, etc… With the TaaS model, the burden of innovation is shifted from the business to the TaaS provider, new capabilities can now be added on-the-fly, and the business can stay at the forefront of technology.

One last thing you should consider is future-proofing your finance organization? Invoice processing is no longer the static business of the past, there are various emerging technology that could transform the business model in the future. For SMB, they can’t afford to dedicate resources to study enablers such as shared ledger like BlockChain, cryptocurrencies like Bitcoin, innovations like artificial-intelligence, etc… With the TaaS model, the burden of innovation is shifted from the business to the TaaS provider, new capabilities can now be added on-the-fly, and the business can stay at the forefront of technology.